More companies eyeing expansion this year, with fewer firms planning job cuts

Construction and oil & gas sectors still downsizing, but at a slower pace

Following a year of massive redundancies caused by the collapse in oil prices, the Gulf region is finally set to witness a stabilisation in job cuts and a moderate rate of new job creation in 2017, according to a survey of over 800 employers across the GCC by GulfTalent.

GulfTalent’s survey, which received participation from senior management of companies across the UAE, Saudi Arabia, Qatar, Kuwait, Oman and Bahrain, was designed to mine insights into employment trends and prospects for the year.

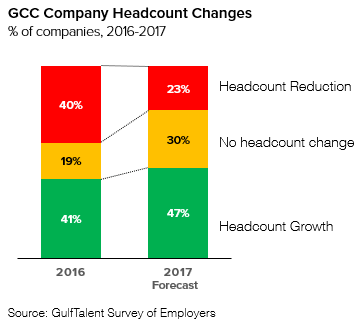

According to the survey findings, the number of companies cutting headcount is set to drop drastically, from 40% of survey respondents in 2016 to just 23% planning cuts this year. At the same time, more firms plan to expand their workforce, increasing from 41% in the past year to 47% in 2017.

Saudi Arabia is a notable exception to the overall positive trend, due to its higher dependence on oil revenues. Data from the survey indicates that the Kingdom continues to be hard hit, with 45% of participating firms expecting headcount reductions in 2017 compared with just 15% of firms in the UAE.

This is consistent with the IMF’s findings, which recently revised down its GDP growth outlook for Saudi Arabia from 2% to 0.4%. However, the Kingdom has embarked on the region’s most ambitious economic reform initiative, the National Transformation Programme, which aims to significantly reduce the country’s dependence on oil over the coming years.

Sector Variations

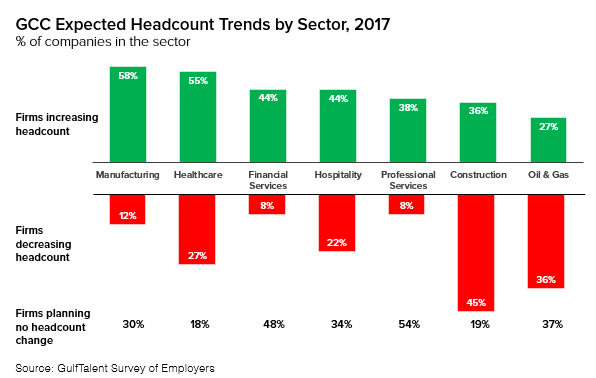

GulfTalent’s survey found significant variations in the fortunes of different sectors across the region.

Manufacturers reported the most positive outlook, with 58% of firms in the sector planning to grow staff numbers in 2017. The sector has been a prime focus of economic diversification efforts by governments over the last couple of years. Some surveyed companies cited streamlined regulations, strong logistics networks and proximity to export markets as factors contributing to their growth. Meanwhile, those who supply products for food and consumer goods are benefiting from the high growth rate among the region’s indigenous population.

Healthcare companies, including hospitals, reported the second highest rate of jobs growth, with 55% of firms planning headcount expansion. This is also largely on the back of increasing demand from a fast growing population, further fueled by government investment and regulatory changes requiring employers to provide medical cover for their employees.

Banks are expecting a relatively positive year, with 44% planning some increase in headcount. Only 8% of surveyed banks plan to cut staff this year, in sharp contrast to 38% who reported cuts in 2016. With the economic outlook more stable, some are taking the opportunity to fill specialist vacancies that were left unfilled last year due to hiring freezes. Furthermore, most banks are actively expanding their collections departments to keep a grip on rising levels of loan defaults.

The oil and gas sector, which has been battered by two years of low oil prices, continues to downsize. However, the pace has moderated, with only a third of firms planning job cuts in 2017, compared with almost half in 2016. Oil firm executives who participated in the survey reported greater optimism, with 77% expecting their 2017 revenues to be higher, thanks to higher oil prices following output cuts agreed in last November’s OPEC meeting.

Construction remains among the region’s worst performing sectors, according to GulfTalent’s survey. 45% of construction firms who participated in the survey reported plans to cut staff numbers this year, only marginally better than the 55% level who reported having cut jobs in 2016. The sector has been hit hard by cuts in government budgets and cancelled or delayed projects. It has also suffered billions of dollars in delayed payments, in some cases resulting in wages for thousands of workers going unpaid for several months.

According to media reports, the Saudi government recently started repaying long overdue payments to its contractors, shortly after its successful $17 billion fund raising in international bond markets.

Shifting Skill Needs

GulfTalent’s research found that many of the same companies reducing staff plan to simultaneously hire during 2017, as natural attrition and changes in business requirements create vacancies that need to be filled.

Some companies are eliminating a range of jobs within their organizations to cut costs, reducing department sizes and consolidating multiple job descriptions within a single hire. This may be good news for those possessing a range of skill sets, though less fortunate for those highly specialized in a single discipline.

This trend has stimulated a demand for training from both companies and individuals seeking to reinforce their capabilities and learn new marketable skills in a highly competitive job market. As a result, GulfTalent has witnessed a surge in demand on its courses platform, including online courses that can be taken remotely, in addition to its core jobs and recruitment services which continue to attract thousands of professionals every day.

Survey Methodology

GulfTalent’s study was based on a survey of 854 senior executives, including CEOs and HR managers of companies across the six countries of the Gulf Cooperation Council (GCC). The survey was conducted during December 2016 and January 2017.